Crypto can be overwhelming, especially when you’re just getting started and trying to figure things out on your own.

There’re just too many steps and plenty of ways you can lose your money permanently if you’re not careful.

But you don’t have to navigate through it all alone.

This guide will provide you with everything you need to move from being a total noob to crypto-savvy in minutes. It’ll give you the basic foundation to build a strong understanding of crypto.

PS: This is the first part of a series of guides focused on onboarding normies to crypto. It’s written for those with very little to no knowledge or understanding of crypto.

What is Cryptocurrency?

From the Barter system to commodities, precious metals (gold and silver coins) to paper money, and then e-money, the idea of money has evolved drastically over time.

Cryptocurrency or crypto is the next stage of this evolution of money.

It’s a new form of digital money that runs on a new technology called blockchain, powered by the internet. In fact, it is money as you know it but in a new form.

blockchain is an open and permanent online ledger system that records all crypto transactions.

Crypto functions similarly to your national fiat currency but without any geographical affiliation or government control.

But unlike your national currency which you can store and spend from your bank or mobile money accounts, cryptocurrencies can only be stored and accessed through electronic wallets.

Comparing Crypto and Fiat Currencies

What are the differences and similarities between fiat and cryptocurrencies? Find out below.

- Fiat currencies are created and controlled by your country’s government, but anyone can create a cryptocurrency.

- Fiat currencies are only legal tenders in the country of issue, but crypto can be used to pay for goods and services anywhere in the world with no geographical limitations.

- The value of cryptocurrencies can increase or decrease significantly within a short time. But the value of fiat currencies is a lot more stable and systematically controlled.

- The supply and value of fiat currencies can be easily controlled by the government, but most cryptocurrencies have a fixed supply and their values are strictly subject to the forces of demand and supply.

- When you spend fiat, your identity is tracked but your crypto transactions are anonymous and in some cases private.

- Sending fiat across borders is slow and expensive (can take days or weeks) but crypto transactions are nearly instant (completed in seconds and minutes).

- Fiat currencies can be counterfeited, but it’s impossible to create a counterfeit of a cryptocurrency.

- Fiat currencies are backed by the military and economic power of the issuing nation. But cryptocurrencies are backed by code and adoption or demand.

- Most fiat transactions can be easily reverted by the banks if necessary, but your crypto transactions cannot be reversed.

- Your bank or government can impose limits on your fiat transactions, but you can send any amount in cryptocurrencies anywhere in the world at any time.

The appeals of crypto

What’s all the fuss about crypto and why should you pay attention to or even consider exploring its full potential?

What do you all do with this crypto thing anyway?

1. Investment opportunity

Crypto offers some of the most lucrative investment opportunities compared to any other financial instrument ever (and equally riskier, just so you know).

This proven potential for significant price appreciation and high returns on investment is one of the major reasons most people get into crypto — to make money.

For example, it’s very easy to get high single-digit or low double-digit APR on your stablecoins in crypto.

stablecoins are cryptocurrencies designed to maintain a stable value by being pegged to fiat (USD). 1 coin = $1. They give you the best of both worlds of crypto and fiat.

Also, a 100% to 500% price increase of your crypto assets within a day or even in hours is a normal occurrence in crypto. Such lucrative potential returns are rare outside crypto.

But don’t make the mistake of thinking crypto is a get-rich-quick scheme, it’s not.

Yes, there’re stories of people making life-changing money with crypto in a very short time with little investments, but those returns can’t be duplicated at will.

That said, even the most conservative investments in crypto offer far greater returns than any other investment instrument in the traditional financial system.

2. For financial sovereignty

There’s a popular saying in crypto “be your own bank“. Crypto empowers you to literally be your own bank by giving you absolute control over your money.

Unlike your bank or government that can impose arbitrary limits or restrictions on when, where, or how much you can transact, crypto has no such barriers.

But with that power comes the great responsibility of securing your crypto assets in the same capacity as a bank would secure your money for you.

You will have to evade hackers, avoid making transfer errors, protect your wallet keys, and a host of other things to secure your money. But this responsibility gets easier as you gain more experience.

Also, with crypto, you can travel anywhere in the world without worrying about currency conversions or carrying cash around.

As adoption continues to grow globally, many people are already living exclusively on crypto as their primary currency.

And if you move to where crypto is not generally accepted all you have to do is convert to the local currency via peer-to-peer networks or any available off-ramp platform.

3. Seamless payment network

Crypto is an exceedingly fast and low-cost payment system. Transactions can be settled in seconds or minutes at a fraction of the cost.

No public holidays, no weekends, no bureaucracy, no restrictions, and no limits. This is why more people and businesses are increasingly accepting crypto globally.

4. Inclusive financial system

In most countries, certain financial services are limited to an exclusive group of people. But all financial services built on crypto are accessible to anyone anywhere in the world.

So, crypto promotes financial inclusivity which many people deeply appreciate and leverage to access otherwise inaccessible financial opportunities.

Types of cryptocurrencies

Every cryptocurrency is either a “coin” or a “token”.

1. Coins

Coins are cryptocurrencies issued on their own custom blockchain and used as the primary currency for transactions within that specific blockchain ecosystem.

To create a coin you must first build a blockchain network for it.

Examples of popular coins are Bitcoin (BTC), Ethereum (ETH), Solana (SOL), BNB (BNB). They’re used to pay for gas or transaction fees on their native blockchain.

2. Tokens

Tokens are cryptocurrencies issued on an existing blockchain. They’re usually created to serve special functions within a platform.

Anyone can easily create a token on a blockchain but building utility for them is the real challenge.

Examples of popular tokens from different chains are Chainlink (LINK), Tether (USDT), Jupiter (JUP), Uniswap (UNI), etc.

Coins vs Tokens

Both coins and tokens can be used to pay for goods and services globally but coins are usually more universally accepted or popular among users.

Tokens are usually limited to use within the specific platform that created them, but coins have wider adoption both within and outside its ecosystem.

Also, you need the coin of the blockchain to pay for gas fees whenever you want to transact with a token. For example, to transfer JUP, you need SOL because JUP is issued on Solana.

How can I invest in crypto

Below are the various ways you can choose to invest in crypto depending on your risk tolerance and preferences.

1. Holding

This is the safest way to invest in crypto. Just buy the coin or token you believe will increase in value given sufficient time and simply hold it in your wallet.

You sell when you reach your profit target or you just continue to hold as a long-term investment that you can even pass on to your loved ones.

Requires no special skills beyond knowing what to buy and securing the keys to the wallet holding them.

2. Trading

Trading is the art of buying and selling crypto assets for quick profit. It’s time and energy-consuming and requires skills and experience to be profitable.

But it’s also the quickest way to make a lot of money in crypto IF you know what you’re doing (big if).

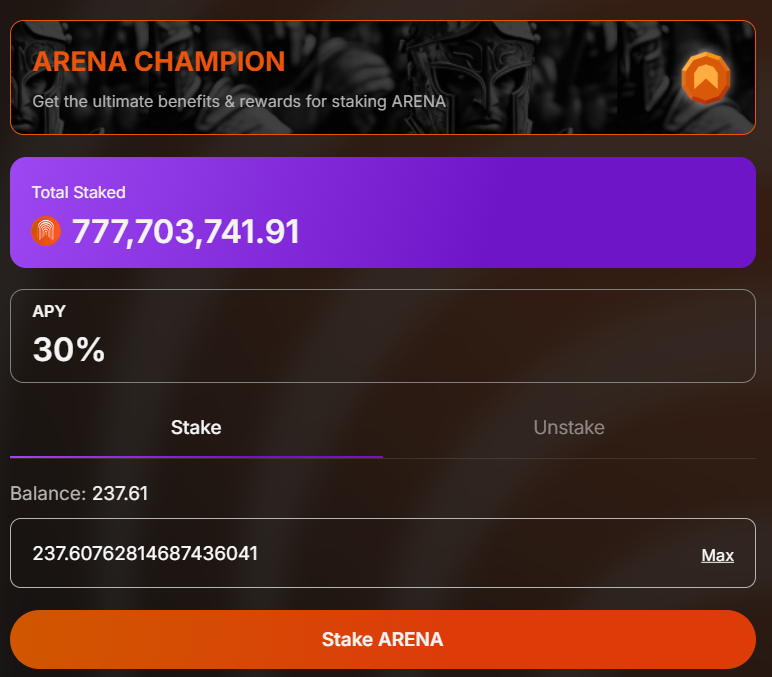

3. Staking

Staking is the art of depositing your crypto assets on a platform to earn rewards. The reward usually comes from new tokens being generated or a share of the platform’s revenue.

For example, we’re currently staking $ARENA token on The Arena platform to earn more $ARENA and $AVAX with 30% APR.

ARENA Staking

Staking gives you the opportunity to put your crypto assets to work while you hold.

So, you will potentially make money from the price of the token going up and also from the additional tokens you receive as a staking reward.

4. Liquidity Mining

Liquidity mining or yield farming is when you deposit your crypto assets in a liquidity pool on a decentralised exchange to facilitate the trading of those tokens and earn a share of all fees generated from the pool.

5. Lending

Lending is the act of depositing your crypto assets on a platform where others can borrow them and earn interest on your deposits.

It’s similar to depositing your money in a savings account with your bank and earning interest but in crypto.

How to get your first crypto

You’ve come so far, now you’re wondering, “how do I get my first crypto” and get started with all these?

1. As a gift from a crypto friend

You can only learn crypto by doing crypto. That’s why we sometimes gift our normie friends some crypto to get them started risk-free.

Usually, if your crypto friend sees you’re serious about getting started they may be more open to gifting you some coins to kickstart your journey.

So, you can ask a friend to help set you up with a small amount to begin testing the waters.

2. Buy directly from someone

I bought my first crypto (BTC) in 2017 from a friend in a face-to-face transaction at my office.

With his help, I installed a Bitcoin wallet, copied my address and sent it to him via WhatsApp, then he transferred $50 worth of Bitcoin to my wallet and I paid him cash.

This is one of the most comfortable ways to buy your first crypto as you have someone right there to walk you through.

3. Buy online with your bank card

Most crypto platforms and wallets now allow you to buy crypto with your bank card. It’s usually as simple as shopping online and paying with your card.

4. Buy from peer-to-peer (P2P) marketplaces

Peer-to-peer crypto marketplaces are where users buy and sell crypto directly with each other, with the platform serving as a trusted escrow.

I mostly use the Binance, Paxful, Bybit, and OKX P2P markets to buy and sell crypto when needed.

They’re fast, cheaper, and more convenient.

PS: The first two do not require KYC (know your customer) verifications, but the last two do. So, if KYC is a major concern for you, you may want to look for someone to buy from directly.

What crypto should you buy first?

It depends on what you plan to do with it, what chain you want to start from, and the level of your risk tolerance.

For example, if you want to start trading memecoins on Solana, the first crypto to buy is $SOL, the native coin of the Solana blockchain. Once you have SOL in your wallet, you can then use it to buy whatever token you want.

But if you just want something relatively safe to buy and hold long-term, then you may want to buy BTC, ETH, SOL, etc.

Also, if you want to join us in staking ARENA to earn that juicy 30% APR, then you’ll have to buy AVAX first and then use the AVAX to buy ARENA on Arena.

Because ARENA is a token issued on the Avalanche blockchain and AVAX is the native currency of the chain. You need the native coin to be able to buy any token on the chain.

So, what coin you buy first depends on what you want to do and what chain you want to use.

Where Do I Store My Crypto Assets?

You can store your crypto assets in a digital wallet you control with a key, or on a centralised exchange or crypto bank like Binance, Coinbase, Kraken, etc.

We highly recommend storing them in a wallet you control for your security and freedom.

But if you don’t want to worry yourself about securing your wallet and prefer the convenience of crypto banks, then by all means, use their services but know the risks.

Centralised exchanges are literally ‘crypto banks’. They’re like your regular bank but for crypto. If they go bankrupt you may lose all or some of your assets with them.

What is a Crypto Wallet?

A wallet is an application that enables you to access and transact with crypto assets on a blockchain.

The wallet does not hold the coins or tokens, they are on the blockchain. It merely provides you with an interface to access the coins.

Now, there are hundreds of blockchain networks and millions of cryptocurrencies. And some wallets only support a single or few blockchains.

That means the first wallet you create will depend on the coin you want to buy and the chain you want to start on.

We highly recommend Phantom Wallet if you’re starting on Solana and Rabby Wallet for every other chain. These two wallets are all you’ll need for a very long time.

3 Key Elements of a Crypto Wallet

Your wallet empowers you to become your own bank in crypto. It’s a critical tool for your crypto adventure and understanding it is a must for the safety of your money.

Below, we discuss the most important elements of your crypto wallet and their functionalities

1. Recovery Phrase

When setting up your wallet for the first time, you’ll be asked to back up your recovery phrase which is like the master key that grants full access to your wallet and funds.

It’s usually a 12 or 24-word combination which you must write down and keep in the most secure place possible.

Whoever knows or has your wallet recovery phrase will have full access to your wallet and can spend all your funds in it.

Nobody should ever see your recovery phrase except it’s someone you don’t mind having full access to your bank.

2. Wallet address

Your wallet represents your bank or bank account while a wallet address serves the same function as your account number.

For every token or blockchain your wallet supports, there’s a unique address you can use to receive funds. This address you can freely share this with anyone who wants to send you money.

3. Private Keys

You can generate multiple accounts in the same wallet. Each account has its own address and private key which grants full access to that account alone.

While a recovery phrase grants full access to all accounts generated in a wallet, a private key only grants full access to a single account associated with it.

Your recovery phrase and private keys must never be seen by anyone, except you want to give them access to your funds.

What are the risks of investing in crypto?

It’s very easy to lose all your money in crypto with no hope of ever getting it back, mostly because you’re entirely responsible for your security and the space is highly unregulated with lots of bad actors.

Below are some of the most popular risks you must beware of.

1. Irreversible mistakes

Crypto transitions are irreversible. So, if you mistakenly send money to the wrong address or you send more than you intended, the money is gone forever.

Your only way out is if the recipient decides to send it back or you know them personally and can get them to refund you.

This risk is heightened when you’re new to the whole crypto thing and not so familiar with everything.

You can mitigate this risk by being extra careful and double-checking every transaction before you click send.

2. Hacks and exploits

Hackers are constantly trying to steal your crypto assets through various means such as phishing, malware, exploiting smart contract vulnerabilities, and SIM swapping attacks.

Again, the best way to mitigate this risk is to be vigilant and mindful of the links you click, where you connect your wallet and the transactions you approve.

Also, when you start staking, lending, or liquidity mining, make sure to use only reputable platforms because they too can be hacked if their security is not strong enough.

3. Volatility

Crypto is extremely volatile, with wild price movements. It’s very normal for a coin to increase or decrease dramatically in a short time.

For example, a -70% price drop or 10,000% price increase in a single day is not uncommon in crypto.

4. Market manipulations

Crypto is mostly unregulated and liquidity isn’t as deep as the traditional stock market, making it prone to market manipulations and insider trading.

For example, centralised exchanges can trade against their users using the same users’ deposited funds.

And project developers and insiders can trade against their investors using insider information that gives them an undue advantage.

Also, due to shallow liquidity ‘whales’ or rich traders can artificially manipulate the price of a coin to exploit unsuspecting investors.

5. Exit Scams or Rug Pulls

Developers of a project you’re invested in can decide to disappear with your money. For example, you hold some coins on an exchange and they close shop. Your money is gone.

Also, if you’re staking or lending on a platform hackers could exploit a vulnerability to steal your deposits.

In some cases, developers of a project ‘hack’ themselves, steal their users’ funds and then claim it was hackers. This happens more times than most people are willing to admit.

And even in no scam situations, a project can go bankrupt or suffer business failure and you still lose all or part of your investment as a result.

6. Loss of Keys

If you lose the device your wallet is on, the next thing is to restore the wallet to another device using your recovery phrase or private keys.

But if you did not back up your recovery phrase or you did but lost it, the wallet and all funds it controls will be lost forever.

Conclusion

One of the best financial decisions you can make right now is investing in crypto, both because it is the future of finance and the vast potential for growth it offers.

From Bitcoin to the latest memecoin, there are thousands of cryptocurrencies you can buy and dozens of other ways to invest in crypto.

And remember, whatever your goals are in crypto, we’re always here to help.

Join our Telegram community where we talk crypto all day, every day with other knowledgeable and passionate crypto investors.